- Solutions

-

Products

-

Resources

Sales Automation: What It Is, How It Works, and What to Automate First by Kristi Campbell View all Blog Posts >Get the App, Get the Sidebar, & Get Your Trial Going HereUnleash limitless growth opportunities by partnering with Cirrus Insight.

- Pricing

Filter By:

- All topics

- Sales Intelligence

- Salesforce

- Sales Productivity

- Sales Strategy

- Sales Prospecting

- Book More Meetings

- Sales Activity Data

- Company News

- AI

- Sales Leadership

- Sales Metrics

- Team Scheduling

- Prospect Smarter

- Serious Insights

- Comparison

- Sync To Your CRM

- Conversation Intelligence

- Email Blast

- Email Campaigns

Sales Forecasting [Methods, Techniques & Benefits]

As a sales professional, you know the role of sales forecasting in the success of your business. You might also know how difficult it is to build an accurate sales forecasting model. Several standard sales forecasting methods exist, but there’s no one-size-fits-all model.

For those new to sales forecasting, it’s a process of predicting future sales revenue based on historical sales data, industry trends, and your current sales pipeline. Forecasting sales revenue is essential for business decisions like budget allocation, new hiring, and production planning.

Accurately forecasting sales helps you set realistic business goals. But a study by Korn Ferry shows that fewer than 25% of sales organizations have 75% or more accuracy in forecasting sales. So how do you build an accurate sales forecasting system?

First, we’ll look at how standard methods for sales forecasting fare in predicting sales. Then, we’ll introduce the structure, process, and methodology framework that we use at Cirrus Insight.

Table of Contents

- What is Sales Forecasting?

- The Importance of Sales Forecasting

- How to Forecast Sales Accurately

- Sales Forecasting Key Factors for Success

- Proven Methods for Sales Forecasting

- Must-Have Features in Sales Forecasting Software

- Frequent Sales Forecasting Issues

- Sales Forecasting with AI Automation

- Forecast Sales with Cirrus Insight

What is Sales Forecasting?

Sales forecasting is the process of predicting future revenue based on a combination of current pipeline data, historical trends, and past sales performance. It provides sales leaders with a data-backed view of where their numbers are headed—whether that’s for the next quarter, the next year, or beyond.

Accurate forecasting enables teams to plan ahead more strategically. From setting realistic quotas to allocating resources, hiring staff, or aligning marketing efforts, sales forecasts help organizations make confident, proactive decisions. Instead of reacting to missed goals or fluctuating performance, teams can stay ahead of the curve.

A reliable forecast begins with the right data—and that’s where your CRM comes in. CRM systems play a critical role in sales forecasting by capturing and organizing the data needed to build an accurate picture of your pipeline. With up-to-date deal stages, engagement activity, and conversion rates at your fingertips, your forecasts can reflect real-time progress and be adjusted as conditions change.

In short, sales forecasting is both a compass and a roadmap—helping sales teams navigate uncertainty and stay focused on the path to revenue growth.

The Importance of Sales Forecasting

Sales forecasting isn't just a sales team responsibility—it's a critical function that impacts nearly every area of the business. When done right, it drives smarter planning, sharper decision-making, and greater financial stability.

Strategic Planning & Resource Allocation

With accurate forecasts, leaders can make informed decisions about hiring, territory planning, and marketing spend. For example, if projections show a slowdown in a particular region, teams can shift focus or reallocate resources to higher-performing areas before results are impacted.

Budgeting with Confidence

Forecasts allow finance teams to build budgets based on expected revenue rather than assumptions. Whether it’s investing in tools, launching new campaigns, or expanding into new markets, forecasts provide the financial visibility needed to move forward with clarity.

Aligning the Organization

When sales, marketing, product, and operations are working from a shared revenue forecast, the entire organization stays aligned on growth goals. This prevents overproduction, underinvestment, and misaligned initiatives that waste time and money.

Building Trust with Stakeholders

For public companies or businesses seeking investment, sales forecasts help build credibility with board members, investors, and financial analysts. Consistent forecast accuracy demonstrates strong leadership and operational discipline—two factors that inspire investor confidence.

Business Impact Example

According to research by the Aberdeen Group, companies with accurate sales forecasts are 10% more likely to grow their revenue year-over-year and 7% more likely to hit their quotas. That’s a direct link between forecasting accuracy and business performance.

In today’s fast-moving market, guessing is a risk you can’t afford. Sales forecasting gives you the data-backed insight needed to stay agile, proactive, and positioned for growth.

How to Forecast Sales Accurately [Best Advice]

Accurate sales forecasting starts with the right data, a clear process, and consistent execution. Here’s how to get it right:

1. Gather the Right Data

To build a reliable forecast, you need more than just your gut—you need quality data. Focus on:

-

Historical Sales Data: Look at past performance by product, team, territory, and time period to identify trends and seasonal patterns.

-

Pipeline Data: Analyze current opportunities by stage, deal size, and expected close date. A well-maintained pipeline is one of the most valuable forecasting tools.

-

Sales Rep Performance: Take into account individual conversion rates and past reliability—some reps close late-stage deals more consistently than others.

-

Customer Behavior: Consider buying cycles, average deal lengths, and response rates. Customer patterns often repeat and can signal what's likely to close.

2. Choose Your Forecasting Method

There’s no one-size-fits-all approach, but here are a few common methods:

-

Historical Forecasting: Projects future sales based on past performance. Great for established teams with consistent cycles.

-

Pipeline Forecasting: Calculates expected revenue by multiplying deal value by the probability of closing (based on pipeline stage).

-

Deal-Stage Weighted Forecasting: Assigns percentages to each stage of the pipeline (e.g., 80% for proposals, 50% for discovery) and calculates weighted totals.

-

AI-Powered Forecasting: Uses machine learning to factor in data from your CRM, sales activity, and win/loss history for more precise predictions.

3. Measure and Track Forecast Accuracy

After each forecast period, compare projected vs. actual results to evaluate how accurate your methods are. This helps identify gaps in pipeline hygiene, rep optimism, or market shifts.

-

Forecast Accuracy (%) = (Actual Sales / Forecasted Sales) × 100

Aim to refine your inputs and assumptions regularly to improve over time.

4. Practical Tips to Improve Forecast Accuracy

-

Keep Your CRM Clean: Inaccurate or outdated data is the #1 reason forecasts miss the mark. Ensure reps regularly update deal stages and close dates.

-

Use a Standardized Sales Process: A defined sales process makes it easier to assign realistic probabilities to each stage.

-

Review Forecasts Weekly: Don’t set it and forget it. A weekly forecast review helps catch changes early and keeps teams accountable.

-

Factor in External Variables: Consider seasonality, market conditions, or industry events that may impact deal velocity.

-

Leverage Forecasting Tools: Use tools like Cirrus Insight to automate data capture, visualize pipeline health, and reduce manual guesswork.

Forecasting isn’t about predicting the future perfectly—it’s about preparing for it intelligently. With the right approach and tools, you’ll have the insight needed to make better decisions and drive predictable growth.

Sales Forecasting Key Factors for Success

Accurate forecasting doesn’t happen by accident. It requires discipline, alignment, and visibility across your sales organization. Here are the key factors that drive successful sales forecasting:

Clean, Reliable Data

Your forecast is only as good as the data behind it. Incomplete or outdated CRM records can lead to inaccurate projections and poor decision-making.

-

Ensure reps regularly update deal stages, values, and close dates.

-

Remove stalled or inactive deals to keep the pipeline honest.

-

Standardize data entry fields to avoid inconsistencies.

Cross-Team Collaboration

Forecasting isn't just a sales function—it requires input from marketing, operations, finance, and customer success.

-

Marketing can provide insight into lead quality and campaign impact.

-

Finance can align forecasts with budgeting and growth plans.

-

CS and support teams can flag risks tied to renewals or satisfaction issues.

Pipeline Visibility

Leaders need a real-time, high-level view of the pipeline—what’s working, what’s stalled, and what’s at risk.

-

Use tools that visualize your pipeline by stage, deal size, and owner.

-

Hold weekly pipeline reviews to surface issues and adjust forecasts early.

-

Segment pipeline data by team, region, or product line for deeper insights.

Strong CRM Practices

Your CRM is the foundation of your forecasting process. When used effectively, it becomes a single source of truth for all revenue data.

-

Integrate your CRM with tools that capture emails, meetings, and activity automatically (like Cirrus Insight).

-

Train reps on how to use the CRM consistently.

-

Set up alerts or automations to flag missing or stale data.

Forecasting Discipline

Build forecasting into your sales rhythm—don’t treat it as a last-minute exercise.

-

Establish a regular cadence for forecast submission and review.

-

Use a consistent method across teams and managers to reduce variance.

-

Compare forecasts to actuals and coach based on the gaps.

When these drivers are in place, forecasting becomes a strategic advantage—not just a numbers game. It leads to stronger decisions, better resource planning, and more predictable revenue.

Proven Methods for Sales Forecasting

Choosing the right sales forecasting method starts with understanding your data, process, and sales environment. Two primary approaches—qualitative and quantitative forecasting—form the foundation, and each has its own advantages depending on your team's maturity and available data.

Quantitative Forecasting Methods

This approach is data-driven and based on historical sales, deal velocity, pipeline stages, and conversion rates. It's best for established sales cycles with consistent deal flow.

Common models include:

-

Historical Forecasting: Using past performance as a baseline

Example: “Last Q3, we closed $1.2M with a 10% QoQ growth rate—so we’re forecasting $1.32M this quarter.” -

Pipeline Stage Forecasting: Applying probability weights to each stage

Example: Deals in Proposal stage (50%) and Negotiation (80%) contribute a weighted value to the forecast. -

Time Series Forecasting: Leveraging trends over time using tools like Excel, BI platforms, or AI analytics.

Tools that support this:

-

CRM pipeline reports (e.g., Salesforce)

-

Forecast dashboards (e.g., Cirrus Insight’s real-time view)

-

AI/ML models for win-rate prediction

Tip: Always clean your data first—remove stale deals, verify close dates, and validate deal stages to avoid overinflated projections.

The SPM Framework: Structure, Process, Methodology

To choose and scale the right forecasting method, apply the SPM Framework:

-

Structure:

Align forecasting to your org's structure. Is it by rep, team, region, or product line? Build forecasts accordingly. -

Process:

Define a regular cadence (weekly, monthly), assign forecast ownership, and use standardized templates or dashboards. -

Methodology:

Select a method that fits your current sales maturity. Use qualitative methods for newer teams or products; quantitative methods as historical data builds. Many teams blend both.

Tips from the Field: Forecasting Best Practices

-

Use AI as a second opinion. Tools like Cirrus Insight's AI assistant surface patterns in behavior and activity that even seasoned managers can miss.

-

Roll up rep-level forecasts with manager oversight. Reps often lean optimistic; managers add realism.

-

Always compare forecast vs. actual. Reviewing accuracy post-quarter helps you course-correct and improve over time.

-

Get cross-team input. Work with marketing, product, and finance to understand upcoming shifts that may affect demand.

Sales forecasting isn’t one-size-fits-all. The best teams blend structured data with human judgment, and continuously refine their methods based on results. With the right framework and tools in place, your forecasts become a competitive advantage—not just a spreadsheet.

Must-Have Features in Sales Forecasting Software

Not all forecasting tools are created equal. To improve accuracy, streamline workflows, and keep teams aligned, your software needs the right set of features. Here are the essentials to look for:

Real-Time Dashboards

Why it matters: Forecasts are only useful if they reflect the current state of your pipeline. Real-time dashboards provide up-to-the-minute visibility into deal progress, rep performance, and forecast status.

What to look for: Tools like Cirrus Insight offer dashboards that update instantly as your team works, ensuring leadership is never making decisions based on stale data.

Pipeline Tracking by Stage

Why it matters: Tracking deals by stage gives you clarity on where revenue is coming from—and where it’s stuck. It also helps apply accurate win probabilities at each phase.

What to look for: Your software should visualize the pipeline by stage, value, owner, and expected close date, and allow for filtering by team, product, or region.

AI Integration

Why it matters: AI helps identify patterns that humans miss—like which deal behaviors correlate with wins or which reps are sandbagging. It can also project revenue based on historical data, rep behavior, and customer interactions.

What to look for: Forecasting tools with AI capabilities, such as Cirrus Insight’s Meeting AI, can automate prospect and customer research to ensure you are prepared and can spend time having high-value interactions the drive closed deals.

CRM Integration & Data Syncing

Why it matters: Manual data entry leads to errors and missing context. Full CRM integration ensures your forecasts are built on clean, current, and complete data.

What to look for: Cirrus Insight, for example, syncs with Salesforce to automatically capture sales activities like emails, calendar events, and call logs—keeping your CRM and forecast in sync without extra admin work.

Customizable Forecast Models

Why it matters: Every business has a unique sales cycle. Your forecasting software should adapt to your process—not the other way around.

What to look for: Support for custom stages, weighted deal logic, and forecasting by category (e.g., commit, best case, upside) ensures your forecasts match how your team sells.

Investing in a forecasting platform with these core features helps your team gain confidence, reduce surprises, and drive predictable revenue growth. With tools like Cirrus Insight, you’re not just tracking deals—you’re building a smarter, more scalable sales process.

Frequent Sales Forecasting Issues

Even the best teams struggle with forecasting accuracy. Here are some of the most common challenges—and how to overcome them:

1. Inconsistent or Incomplete Data

Problem: When reps don’t update CRM records regularly, your forecast reflects outdated or incorrect information.

Solution: Establish clear data hygiene standards. Use automation tools to capture activity (like emails and meetings) and reduce manual entry.

2. Lack of a Standardized Forecasting Process

Problem: Without a defined methodology, each manager or rep may forecast differently, leading to inconsistent results.

Solution: Align your team around a consistent forecasting model (e.g., stage-based or historical) and cadence. Provide training and clear guidelines.

3. Poor Pipeline Visibility

Problem: Leaders can’t spot risks or trends when the pipeline isn’t properly segmented or visualized.

Solution: Use tools that offer real-time dashboards and views by stage, rep, deal size, and forecast category. Schedule recurring pipeline review meetings.

4. Ignoring External Variables

Problem: Forecasts that rely only on internal data may miss market shifts, seasonality, or competitive threats.

Solution: Factor in macro trends, industry shifts, and known seasonality to adjust forecasts. Collaborate with marketing and product teams to stay ahead of changes.

5. Forecasting as an Afterthought

Problem: Treating forecasting as a one-off task leads to rushed, unreliable projections.

Solution: Make forecasting part of your sales rhythm. Tie it into weekly meetings, rep 1:1s, and performance reviews.

Avoiding these pitfalls takes intentional effort, but the payoff is real: more predictability, fewer surprises, and greater confidence across your revenue organization.

Sales Forecasting with AI Automation

AI is transforming the way modern sales teams forecast—taking the guesswork out and replacing it with real-time, data-backed insights. By detecting patterns, minimizing human bias, and continuously learning from new data, AI helps create forecasts that are faster, more accurate, and scalable across the entire sales organization.

Real-Time Forecast Adjustments

AI-powered forecasting tools automatically analyze deal changes, sales activity, and customer behavior to update forecasts on the fly. No more waiting for manual updates or end-of-week reports—AI keeps your forecast current and responsive to shifting pipeline dynamics.

Pattern Detection & Predictive Modeling

AI looks at historical sales performance, buyer engagement signals, rep behavior, and deal velocity to spot patterns that predict success—or risk. These models help forecast which deals are most likely to close, when, and for how much—without relying solely on rep intuition.

Built Into Modern CRM Systems

Today’s advanced CRMs are embedding AI directly into forecasting workflows. For example:

-

Cirrus Insight’s Meeting AI analyzes customer interactions and call data to surface insights that reps can use to prepare more effectively and prioritize high-value opportunities.

-

AI-enhanced forecasting engines in CRMs like Salesforce Einstein and HubSpot predict deal outcomes using a blend of historical data, engagement metrics, and machine learning models.

Benefits of AI in Forecasting

-

Speed: AI automates time-consuming analysis and updates forecasts instantly as conditions change.

-

Accuracy: Machine learning models improve over time, becoming more precise with each new data point.

-

Scalability: AI allows leaders to generate forecasts across large teams, geographies, and product lines—without relying on spreadsheets or manual rollups.

In short, AI gives sales teams a smarter way to predict revenue. With less manual input and more predictive insight, you can focus less on building forecasts—and more on hitting them..png?width=650&height=496&name=meetingai-Sidebar%20(8).png)

Forecast Sales with Cirrus Insight

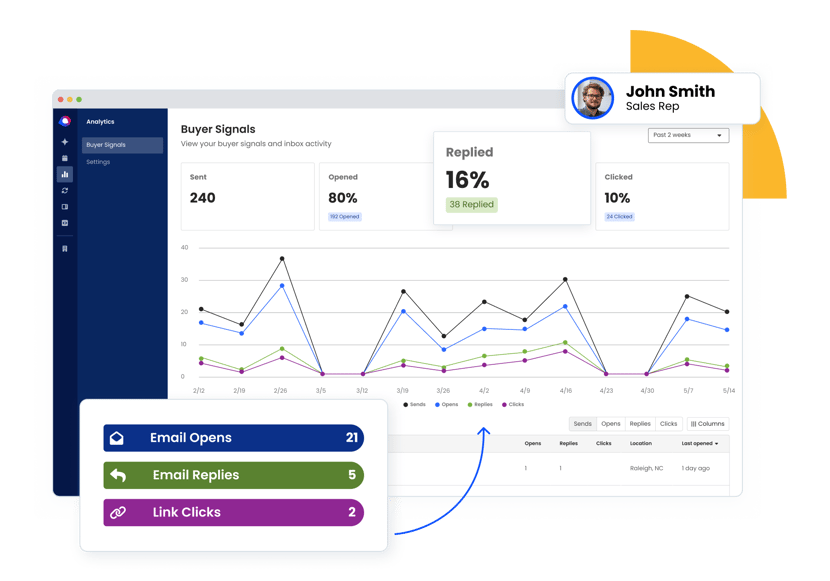

Accurate forecasting starts with accurate data—and Cirrus Insight helps sales teams get it right at the source. By integrating directly with your CRM and embedding into your team’s daily workflow, Cirrus Insight ensures that every email, meeting, and activity is automatically captured and reflected in your sales pipeline.

Seamless CRM Integration

Cirrus Insight syncs with Salesforce in real time, eliminating manual data entry and reducing the risk of outdated or incomplete records. Reps can update deal stages, log activities, and view pipeline insights without ever leaving their inbox or calendar.

Smarter Pipeline Visibility

Visualize your pipeline with clear, customizable views that show deal progression, close probabilities, and rep activity. Sales leaders can spot bottlenecks early, drill into high-value opportunities, and keep forecasts grounded in real activity.

AI-Powered Meeting Intelligence

Meeting AI, a feature within Cirrus Insight, automatically analyzes calls and customer interactions to surface insights that can inform your forecasting models. It helps reps prepare more effectively and gives managers visibility into deal momentum.

Built for Sales Teams

Cirrus Insight doesn’t require a new process—it enhances the one your team already uses. By sitting inside the tools your reps already live in (like Gmail, Outlook, and Salesforce), it makes data capture seamless and forecasting more reliable as a result.

Whether you’re building your first forecast or refining a complex revenue model, Cirrus Insight helps lay a stronger foundation—by improving pipeline data quality and making your CRM work smarter.

Frequently Asked Questions (FAQs)

How do you forecast sales?

Sales forecasting involves analyzing historical data, current pipeline activity, and market trends to estimate future revenue. Common techniques include using weighted pipeline stages, historical averages, or AI-powered predictions.

Who is responsible for sales forecasts?

Sales leaders typically own the forecasting process, but accurate forecasts require input from sales reps, finance, marketing, and operations to reflect a complete view of the business.

Who uses sales forecasts?

Sales forecasts are used by multiple departments—sales teams, executives, finance, marketing, and even investors—to guide planning, budgeting, hiring decisions, and strategy.

How accurate are sales forecasts?

Forecast accuracy varies depending on the quality of data and methodology used. Many teams average 75–90% accuracy, but using automation and AI tools can improve this significantly over time.

How do CRM systems forecast revenue?

CRM systems like Salesforce analyze deal size, stage, activity history, and rep input to predict revenue. Many platforms now incorporate AI to identify trends and automatically adjust forecasts based on real-time data.

What does the sales forecasting process look like?

It generally includes reviewing historical sales data, analyzing current pipeline health, applying a consistent forecasting model, and comparing predicted revenue to actuals. This is typically done on a weekly or monthly basis.

Which are the best sales forecasting tools?

Top forecasting tools include Salesforce, HubSpot, Clari, Gong, and Cirrus Insight. These platforms offer features like pipeline visibility, AI integration, CRM syncing, and real-time dashboards to improve forecasting accuracy.

.png?width=1268&height=1772&name=Sidebar-C%20(1).png)